AutoSys cuts into supply chain of US, Japan auto makers

Written by Nuying Huang, Taipei; Rodney Chan, DIGITIMES Asia Tuesday 5 November 2024

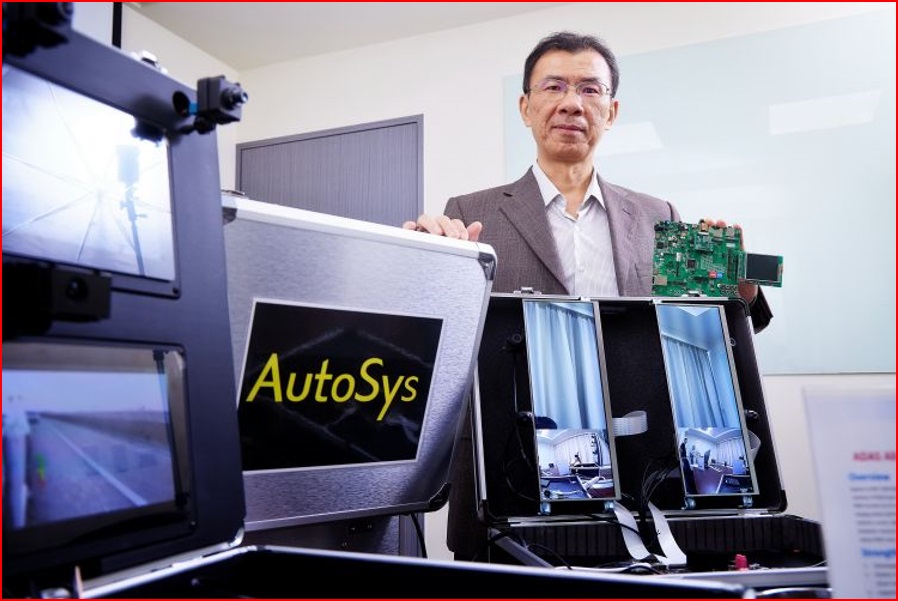

AutoSys GM, Hsu Chang-Feng. Credit: DIGITIMES

Taiwan-based AutoSys, which specializes in algorithms for automotive 360-degree surround image detection and ADAS sensing system fusion, has penetrated the supply chains of the US and Japanese automotive markets.

Following its penetration into the automotive supply chains in the US and Japan, the company is also expecting sales contribution from Chinese carmakers to start in 2025.

AutoSys noted that the company’s flexible software platform can be quickly adopted for multiple automotive chips. Automakers, tier-1 suppliers, and system vendors can easily integrate hardware and software for different car models using its solutions, it said.

For international orders, it has made gains in the commercial vehicle market in the US. The company said a US client has already begun volume production using AutoSys’ solution.

AutoSys said it has also teamed up with three major Taiwanese electronic device makers to penetrate the international car market leveraging international IDMs’ chip solutions.

The company said it has also entered the supply chain supporting Japan’s smart vehicle sector. It has teamed up with a Taiwanese tier-1 supplier that has long been a partner of Japanese automakers.

AutoSys has already completed the smart cockpit and ADAS system developments for two Japanese automakers, one of which is a top-2 Japanese carmaker. AutoSys said its systems are being adopted in new car models, with road tests having been done on about 1,000 vehicles.

Making inroads into Chinese car market

In 2024, AutoSys has already made inroads into the Chinese market, where vehicles are fast switching to electrical and electronic architectures (EEA). China is the most mature and biggest EEA market, and while competition there is the most intense, players in the automotive industry are all keen on establishing a foothold in China’s car market.

AutoSys said that the company develops solutions in line with chip partners’ market differentiation. It has leveraged NXP chips to enter the midrange to high-end smart cockpit and ADAS segments. It has also worked with WPI to exhibit smart cockpit solutions using NXP’s iMX.93 in Wuhan, China.

AutoSys said it has also reached agreements with two Chinese automotive chip vendors. As China is keen to raise its automotive chip self-sufficiency, these chip vendors have already partnered with specific Chinese automakers.

AutoSys said it originally expected its 2024 sales to triple, but now it seems that they stand a good chance of quadrupling. While the US and Japanese markets have contributed to AutoSys’ sales for more than a year, sales contribution from China will not start until 2025. Initially, China sales will account for 20-30% of overall company sales.